Contact Seller

FREE Tax Workshops in Hays!!

Description

It's that time of year again! Join us for our FREE tax workshops. Pick the workshop that fits you or choose them all!

The Kansas SBDC is proud to offer Kansas Dept. Of Revenue Sales and Compensating Use Tax for retail businesses and contractors presented by KDOR Tax Specialist, Carl York. Attendees will gain a basic understanding of the goods and services subject to sales tax and applicable exemptions. The presenter will explain the differences between the Kansas Retailer’s Sales Tax, the Kansas Retailer’s Compensating Use Tax, and the Kansas Consumer’s Compensating Use Tax.

The Kansas Dept. of Labor Understanding Regulations: Unemployment Tax Workshop will be presented by KDOL State Auditor, Brett Gerber. This course is an overview of the Kansas unemployment tax requirements including, Unemployment Insurance (UI) Tax Liabilities, applying for a UI tax account, steps for filing tax returns, new hire info, State Information Data Exchange System, and classifying an Independent Contractor.

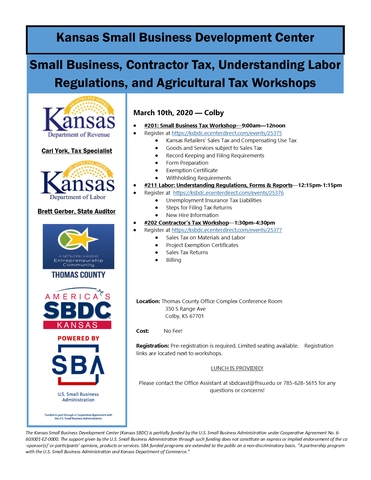

March 10th - Colby CANCELLED

#201: Small Business Tax Workshop—9:00am—12noon

- Register at https://ksbdc.ecenterdirect.com/events/25375

- Kansas Retailers’ Sales Tax and Compensating Use Tax

- Goods and Services subject to Sales Tax

- Record Keeping and Filing Requirements

- Form Preparation

- Exemption Certificate

- Withholding Requirements

#211 Labor: Understanding Regulations, Forms & Reports—12:15pm-1:15pm

Lunch will be provided

- Register at https://ksbdc.ecenterdirect.com/events/25376

- Unemployment Insurance Tax Liabilities

- Steps for Filing Tax Returns

- New Hire Information

#202 Contractor’s Tax Workshop—1:30pm-4:30pm

- Register at https://ksbdc.ecenterdirect.com/events/25377

- Sales Tax on Materials and Labor

- Project Exemption Certificates

- Sales Tax Returns

- Billing

Location: Thomas County Office Complex Conference Room

350 S Range Ave

Colby, KS 67701

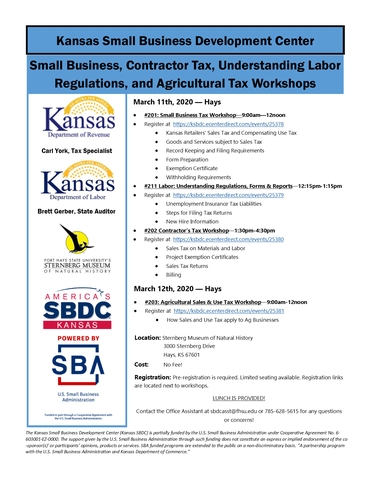

March 11th - Hays

#201: Small Business Tax Workshop—9:00am—12noon

- Register at https://ksbdc.ecenterdirect.com/events/25378

- Kansas Retailers’ Sales Tax and Compensating Use Tax

- Goods and Services subject to Sales Tax

- Record Keeping and Filing Requirements

- Form Preparation

- Exemption Certificate

- Withholding Requirements

#211 Labor: Understanding Regulations, Forms & Reports—12:15pm-1:15pm

Lunch will be provided

- Register at https://ksbdc.ecenterdirect.com/events/25379

- Unemployment Insurance Tax Liabilities

- Steps for Filing Tax Returns

- New Hire Information

#202 Contractor’s Tax Workshop—1:30pm-4:30pm

- Register at https://ksbdc.ecenterdirect.com/events/25381

- Sales Tax on Materials and Labor

- Project Exemption Certificates

- Sales Tax Returns

- Billing

March 12th, 2020 — Hays

#203: Agricultural Sales & Use Tax Workshop—9:00am-12pm

- Register at https://ksbdc.ecenterdirect.com/events/25381

- How Sales and Use Tax apply to Ag Businesses

Location: Sternberg Museum of Natural History

3000 Sternberg Drive

Hays, KS 67601

Registration: Pre-registration is required. Limited seating available. Registration links located next to workshops.

Please contact the Office Assistant at sbdcasst@fhsu.edu or 785-628-5615 for any questions or concerns!

The Kansas Small Business Development Center (Kansas SBDC) is partially funded by the U.S. Small Business Administration under Cooperative Agreement No. 6-603001-EZ-0000. The support given by the U.S. Small Business Administration through such funding does not constitute an express or implied endorsement of the co-sponsor(s)’ or participants’ opinions, products or services. SBA funded programs are extended to the public on a non-discriminatory basis. ‘’A partnership program with the U.S. Small Business Administration and Kansas Department of Commerce.”